Gross wages

What are gross wages?

What are gross wages?

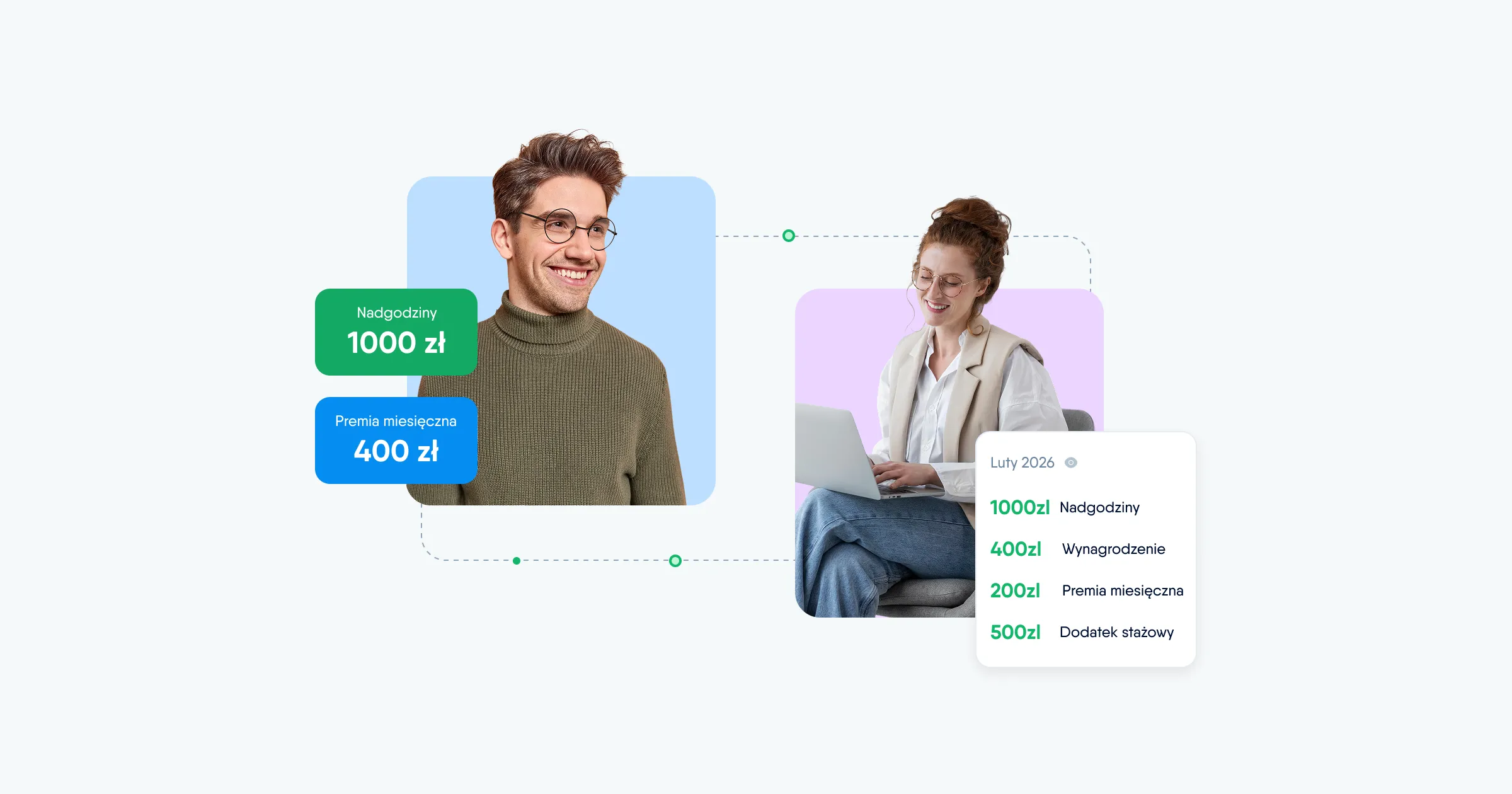

Gross wages refer to the total amount of money earned by an employee before any deductions or taxes are taken out. It includes the employee's regular wages, as well as any overtime pay, bonuses, commissions, and other forms of compensation.

Gross wages are the amount that the employer agrees to pay the employee for the work they have done, before any withholdings or deductions. However, it's important to note that gross wages do not necessarily represent the amount of money that an employee will take home, as taxes and other deductions will be subtracted from the gross pay to determine the net pay that the employee will receive.

What’s the difference between gross and net wages?

The main difference between gross and net wages is that gross wages refer to the total amount of money earned by an employee before any deductions, while net wages refer to the amount of money an employee receives after all deductions have been taken out.

Gross wages are the employee's total pay before any taxes or other deductions, such as contributions to retirement plans, health insurance, or other benefits, are taken out. Gross wages include not only an employee's base pay, but also any additional income like bonuses, overtime pay, or commissions.

Net wages, on the other hand, are the employee's pay after all deductions have been taken out, including taxes, social security, and any other withholdings. The net wages are the actual amount an employee receives in their paycheck or direct deposit.

What kinds of companies provide wages as gross wages?

In most countries, gross wages are the standard method for determining an employee's compensation, and many different types of companies use this approach. This includes small businesses, large corporations, non-profit organizations, government agencies, and more.

In general, any company that has employees who are paid a regular salary or hourly wage will use gross wages as the starting point for calculating their compensation. This means that most industries and sectors, including retail, healthcare, finance, education, and technology, among others, will provide wages as gross wages.

However, some industries or sectors may have more complex compensation structures that involve bonuses, commissions, or other forms of variable pay, which can make it more difficult to calculate gross wages accurately. In these cases, companies may use specialized software or consult with accounting or HR professionals to ensure that their employees are being paid accurately and in compliance with applicable laws and regulations.

How do HR professionals manage gross wages?

HR professionals are responsible for managing the entire process of compensation and benefits, including the calculation and administration of gross wages. Here are some of the key steps involved in managing gross wages:

- Establish pay structures: HR professionals work with company leaders to establish pay structures, including base salaries, bonuses, and other forms of compensation.

- Set pay rates: One determines the pay rate for each employee based on their job role, level of experience, education, and other factors.

- Calculate gross wages: You then calculate the gross wages for each employee based on their pay rate and the number of hours they work.

- Deduct taxes and other withholdings: Deduct taxes, social security, and other withholdings from the employee's gross wages to arrive at their net pay.

- Manage benefits: HR professionals also manage employee benefits, such as health insurance, retirement plans, and paid time off. These benefits may be deducted as well.

- Ensure compliance: Finally, one must ensure that the company is in compliance with all applicable laws and regulations related to compensation, including minimum wage laws.

Ultimately, the best way you can manage your company’s gross wages system is by using an HRM platform like PeopleForce as this will allow you to control all information about employees, wages, policies etc, in one place. Request a free demo today to learn more about how you can use this system to automate all your key HR processes.