Gross vs. Net income

Gross Pay vs. Net Pay: What's the Difference?

What is gross income?

Gross income refers to the total amount of income earned by an individual or business before any deductions or taxes are applied. It includes all forms of income, such as wages, salaries, tips, rental income, interest, dividends, and capital gains. Gross income is often used as a starting point to calculate an individual's or company's tax liability, as it provides a clear picture of the total amount of income earned during a specific period of time.

What is net income?

Net income refers to the amount of income that remains after all deductions and taxes have been applied to gross income. Net income represents the amount of money that an individual or business actually receives and can use for spending or investing. To calculate net income, all deductions and taxes, such as income tax, social security tax, and healthcare tax, are subtracted from gross income.

What’s the difference between gross and net income?

The main difference between gross and net income is that gross income is the total amount of income earned by an individual or business before any deductions or taxes are applied, while net income is the amount of income that remains after all deductions and taxes have been applied to gross income.

Gross income includes all forms of income, such as wages, salaries, tips, rental income, interest, dividends, and capital gains. Net income is the amount of income that is actually received and available for spending or investing after all applicable deductions, such as taxes, retirement contributions, and other benefits, have been subtracted from gross income.

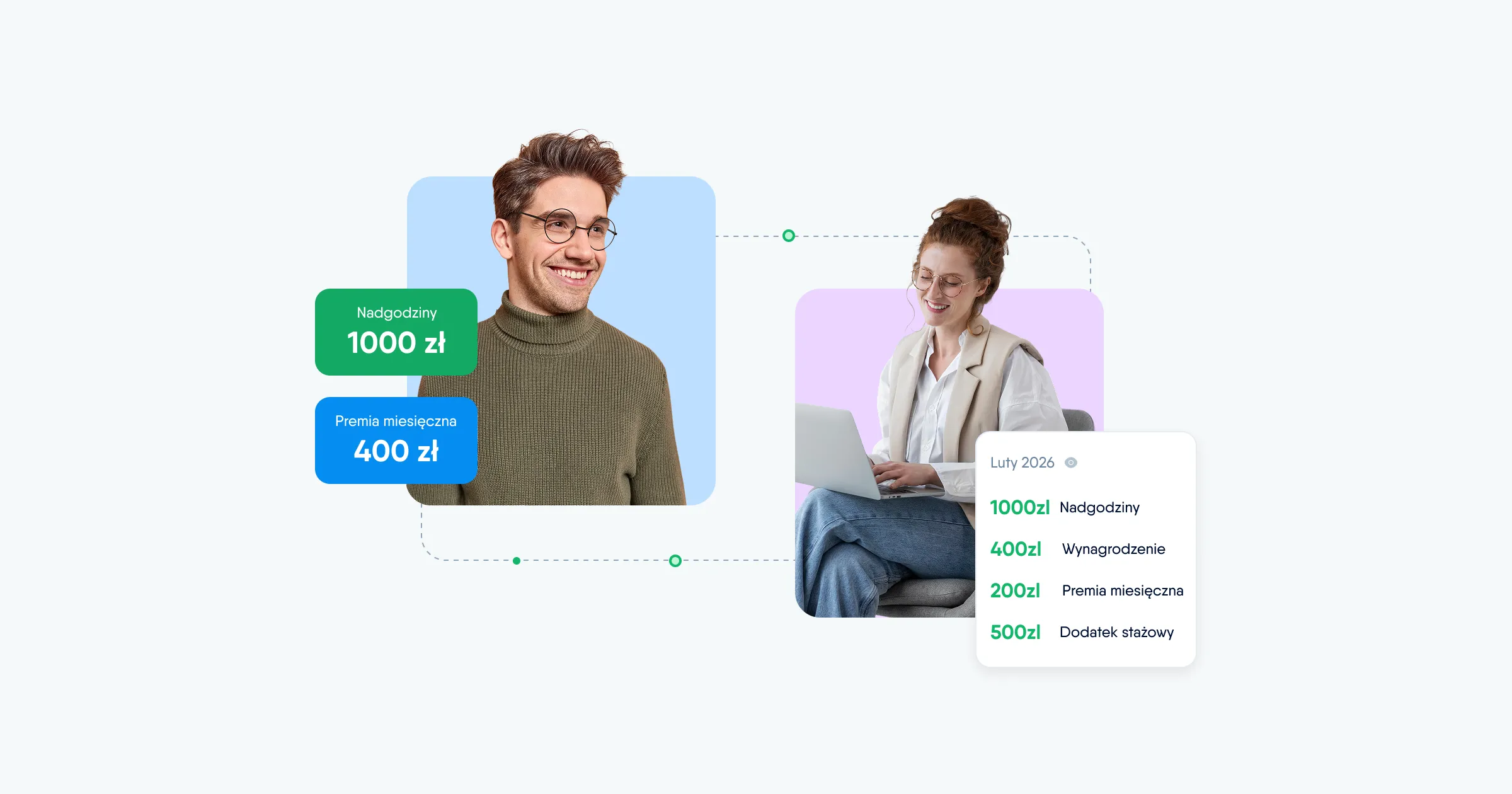

To effectively manage your company's gross wages system, utilizing an HRM (Human Resource Management) platform such as PeopleForce can be highly beneficial. By utilizing PeopleHR, you can keep track of all employee-related information, policies, wages, and more in one centralized location, making it easier to manage and control the entire process.

You can start this process by requesting a free demo of PeopleForce today. This will allow you to learn more about how this system can streamline your HR operations and improve the overall efficiency of your business.