Gross income

What is gross income?

What is gross income?

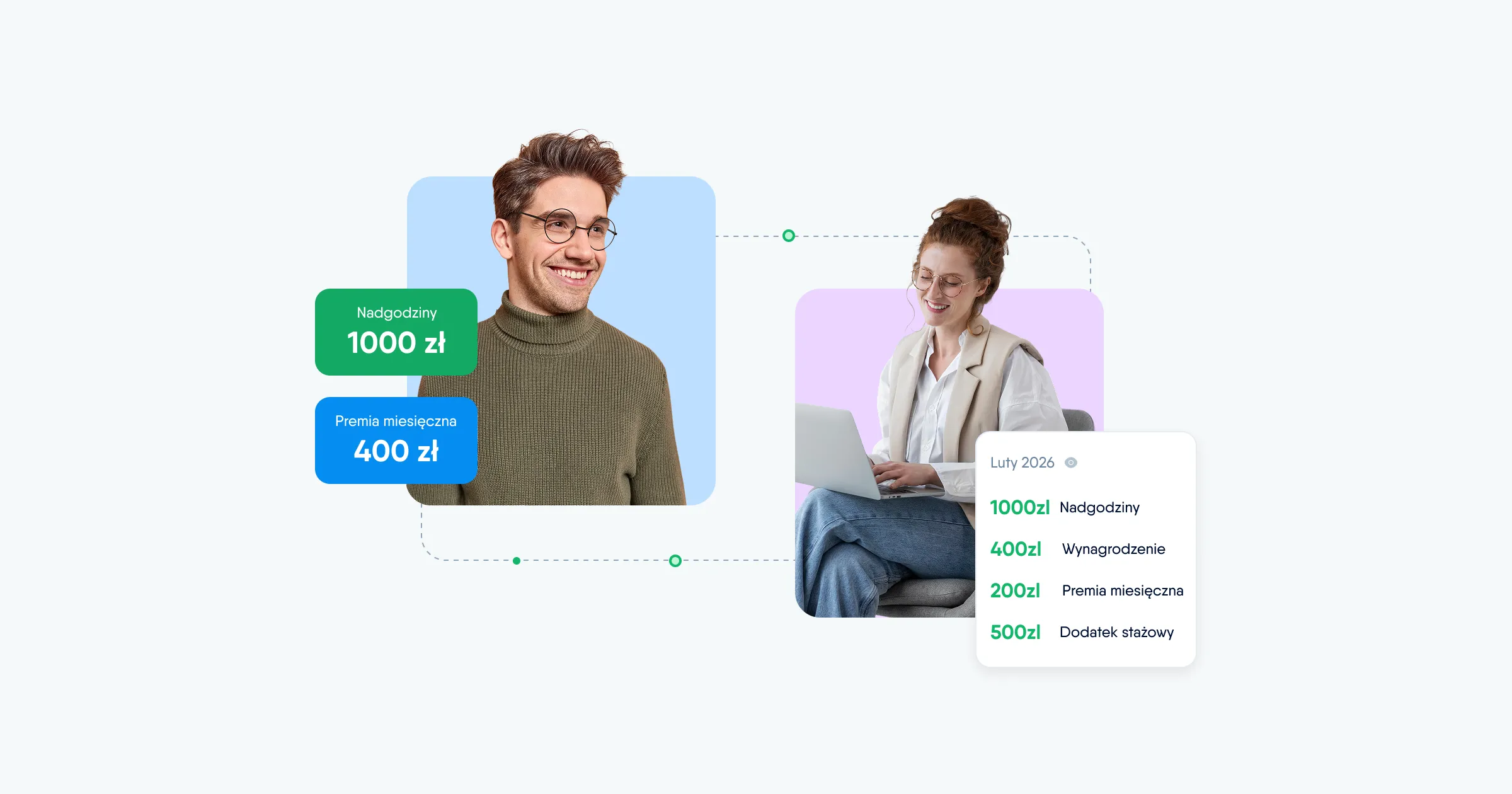

Gross income is the total pre-tax compensation specified in an employment contract, including base salary, bonuses, overtime pay, compensation for difficult working conditions, and various mandatory contributions. Once all tax advances and contributions are deducted, the employee receives the net amount.

What affects net pay?

Taxes

Taxes, such as federal income tax as well as state (in the United States) and local taxes, depending on the jurisdiction, are typically deducted directly from gross pay. These deductions are calculated based on the employee's income level and tax status. In most countries, income taxes are deducted directly from gross pay.

Health insurance

In countries where health insurance is linked to employment, such as the U.S., employees enrolled in company health plans often have their portion of the premium deducted from their gross pay. The premium amount can vary significantly depending on the coverage level and the employer's contribution.

Social Security and Medicare taxes

Many countries have social insurance programs funded by payroll deductions. In the United States, these include Social Security and Medicare contributions.

Retirement savings

Many countries encourage retirement savings through payroll deductions. In the U.S., contributions to retirement plans are often directly deducted from paychecks.

Voluntary deductions

Employees may opt for additional payroll deductions for various benefits. In the U.S., these can include contributions to Health Savings Accounts (HSA), Flexible Spending Accounts (FSA), and additional insurance (life, disability, dental, vision), among others.

What are the main components of gross income?

The main components of gross income typically include:

- Base salary or wages – the fixed annual or hourly pay agreed upon for a specific role.

- Bonuses – additional compensation based on performance, company profits, or meeting certain goals.

- Commissions – earnings based on sales or business generation, common in sales roles.

- Paid Time Off (PTO) or vacation pay – the financial equivalent of paid leave days or vacation time, which is often included as part of total compensation.

- Overtime Pay – extra pay for hours worked beyond the standard workweek, typically at a higher hourly rate.

- Retirement contributions – employer contributions to retirement accounts.

- Health and wellness benefits – the value of insurance premiums paid by the employer, along with wellness incentives or reimbursements.

- Allowances and perquisites (perks) – additional payments or reimbursements, like transportation, meal allowances, or housing stipends.

- Stock options or equity – company shares or options given to employees as part of compensation, allowing them to benefit from the company's financial success.

- Profit sharing – a share in the company's profits, which can vary depending on company performance.

These components collectively make up an employee’s gross income from the company, varying by role, company policies, and industry practices.

Differences between gross income and total income for employees

Gross income and total income are related but differ in important ways:

- Total Income: This is the entire amount earned by an employee before any deductions and includes all additional material benefits, such as non-wage benefits, perks, holiday pay, etc.

- Gross Income: This term refers to the pre-tax wage or salary amount (excluding non-wage benefits), from which employment-related costs, contributions, and taxes will subsequently be deducted.

From the employee’s perspective, the distinction between total income and gross income can impact tax filings and creditworthiness evaluations. Some financial institutions may consider total income rather than just gross income.

Why including gross income in job offers matters

Including the gross income range in a job offer provides candidates with a general understanding of the compensation level at the company. Disclosing gross income helps applicants set realistic salary expectations, minimizing potential misunderstandings during salary negotiations.

Providing salary information can also accelerate the recruitment process, screening out candidates with different financial expectations. From the candidate's perspective, a company that shares financial information is viewed as a transparent and fair employer.